Understanding Liability Insurance

Your Complete Guide to Protection and Peace of Mind in 2024

Introduction to Liability Insurance

Liability insurance is your financial shield against the unexpected, providing essential protection when you're legally responsible for causing harm to others or their property.

What You'll Learn

- Different types of liability coverage

- How to choose appropriate coverage limits

- State-specific requirements

- Tips for reducing your premiums

Key Point: Liability insurance is mandatory in most states and serves as your primary financial protection against claims and lawsuits.

Key Benefits of Liability Insurance

Financial Protection

Covers legal expenses, medical bills, and property damage costs if you're found at fault in an accident.

Legal Compliance

Meets state requirements and ensures you're legally allowed to drive or operate your business.

Types of Liability Coverage

Bodily Injury Liability

Covers medical expenses, lost wages, and legal fees if you're responsible for injuring someone in an accident.

- Medical expenses

- Lost wages

- Legal defense costs

- Pain and suffering damages

Property Damage Liability

Covers repair or replacement costs for other people's property that you damage in an accident.

- Vehicle repair costs

- Building damage

- Personal property

- Public infrastructure

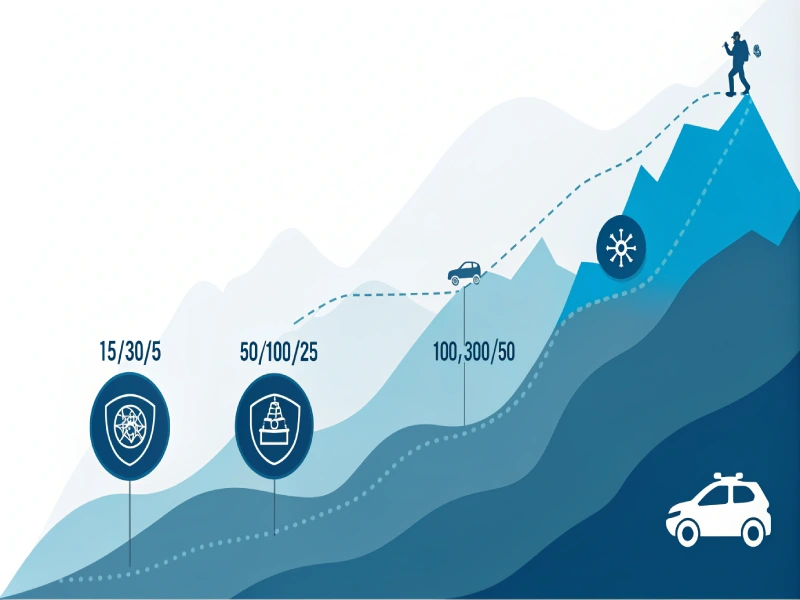

Understanding Coverage Limits

Coverage Limit Examples

| Coverage Type | Example Limit | Description |

|---|---|---|

| Per Person | $50,000 | Maximum for each injured person |

| Per Accident | $100,000 | Maximum for all injuries in one accident |

| Property Damage | $50,000 | Maximum for property damage |

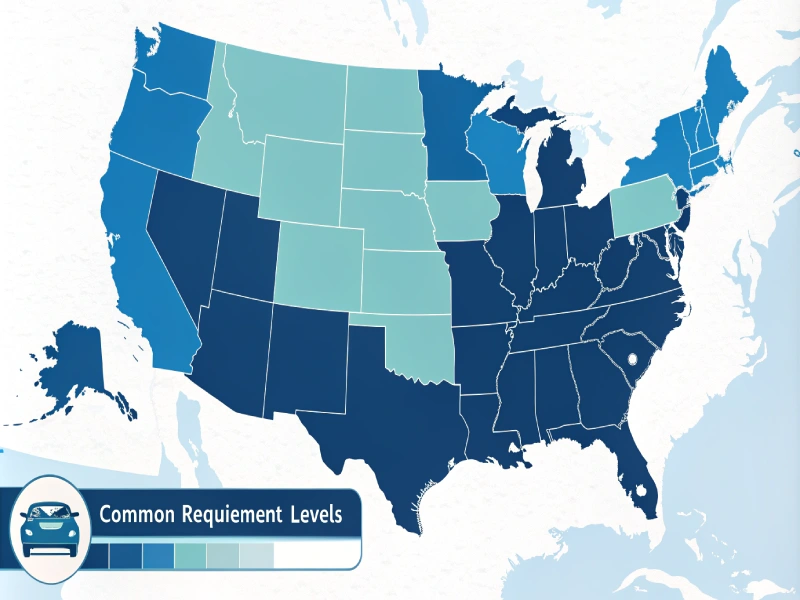

State Requirements

Important: Consider purchasing higher limits than your state's minimum requirements to better protect your assets.

Filing a Liability Claim

Claims Process Steps

- 1 Document the accident scene

- 2 Exchange information with other parties

- 3 Contact your insurance company

- 4 Provide requested documentation

- 5 Cooperate with claims adjuster

Frequently Asked Questions

Requirements vary by state. Most states require minimum coverage of:

- $25,000 for bodily injury per person

- $50,000 for bodily injury per accident

- $25,000 for property damage

Premium Calculator

Estimate your liability insurance premium based on your specific needs.

Try Our Calculator